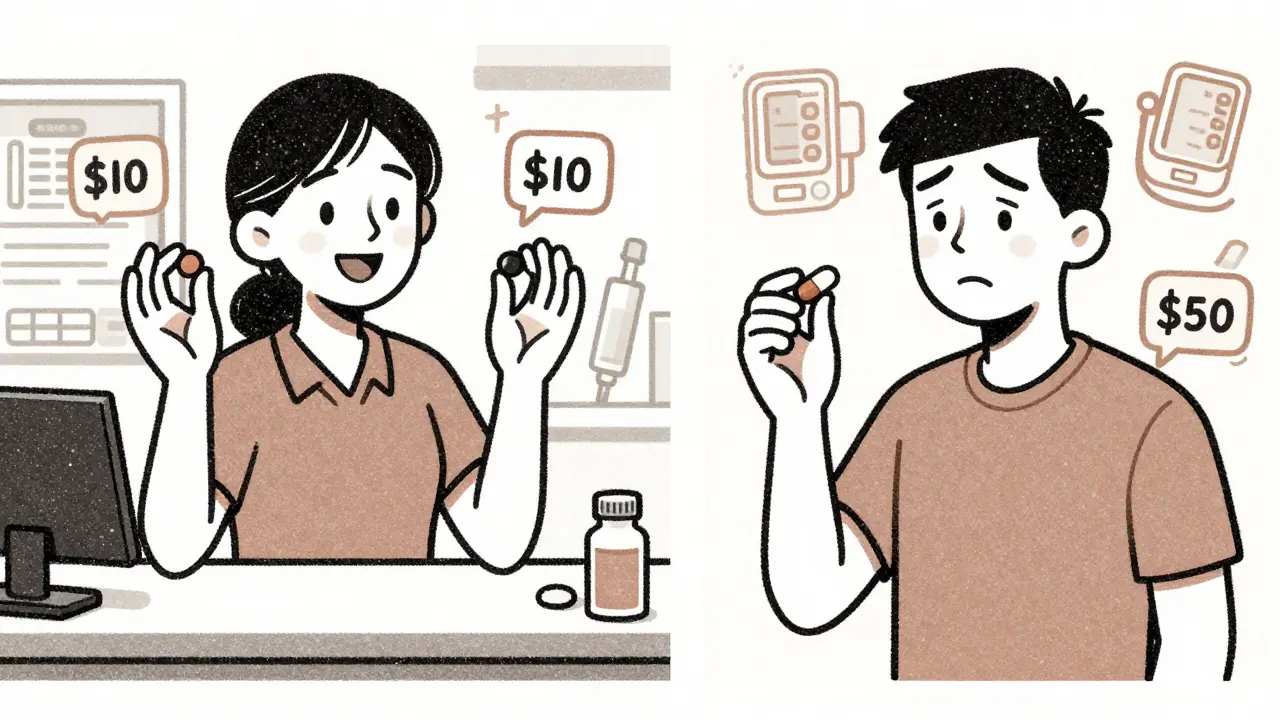

When you’re on multiple medications for high blood pressure, diabetes, or cholesterol, you might notice something strange: your insurance covers two separate generic pills for $10 each, but the generic combination pill that contains the exact same ingredients costs $50. Why? It’s not a mistake. It’s how insurance formularies work-and it can cost you hundreds a year if you don’t understand it.

What Exactly Is a Generic Combination Drug?

A generic combination drug is a single pill that contains two or more active ingredients, each already available as a standalone generic. For example, a common blood pressure combo might include lisinopril and hydrochlorothiazide. Instead of taking two pills, you take one. These combinations were originally developed by brand-name companies, but once patents expire, generic manufacturers can make them too.The FDA confirms these generics are bioequivalent to their brand-name counterparts. That means they work the same way in your body. But insurance companies don’t always treat them the same way when it comes to cost.

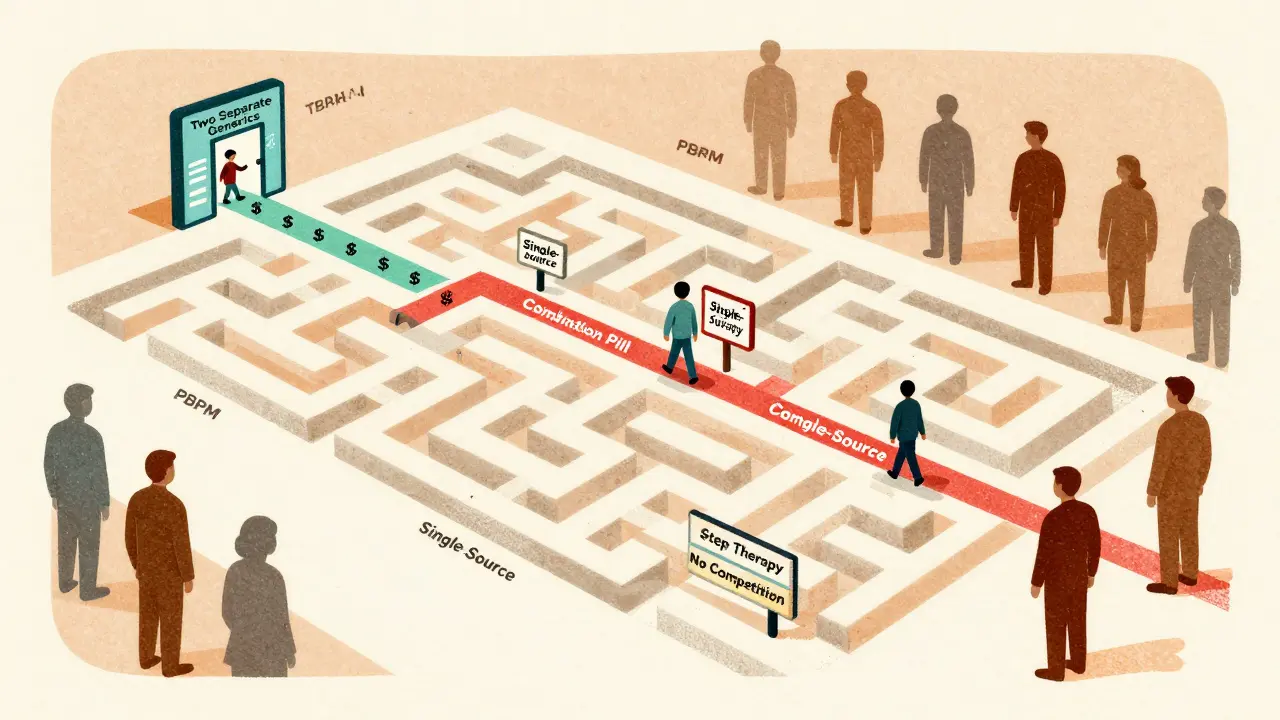

How Insurance Plans Decide What to Cover

Most U.S. insurance plans-Medicare Part D, employer plans, and private insurers-use a tiered system to control drug costs. Tier 1 is for the cheapest drugs: usually generic medications. Tier 2 and 3 are for brand-name or non-preferred drugs. Specialty tiers are for expensive biologics or rare treatments.Here’s the twist: a generic combination drug might be placed in Tier 2 or even Tier 3, while the two individual generics are both in Tier 1. That means you pay less for two separate pills than for one combo pill-even though they contain the same chemicals.

Why? Because insurers sometimes assume you’ll save money by buying two low-cost generics. But they don’t always account for the hassle, or the fact that you might forget one pill. And sometimes, the combo pill is priced higher because it’s a single-source generic-meaning only one company makes it, so there’s no competition to drive the price down.

Real Costs: A Patient’s Perspective

In 2024, the average copay for a Tier 1 generic in Medicare Part D was $1-$15. For a brand-name drug, it was $47-$112. But for a generic combination? It could be anywhere from $0 to $50, depending on your plan.One patient in Brisbane, Australia, who’s familiar with U.S. insurance rules, shared this experience: “My plan covered the two separate generics for $10 each, but the combo was $48. I asked my doctor to write two prescriptions instead. I saved $38 a month-$456 a year.”

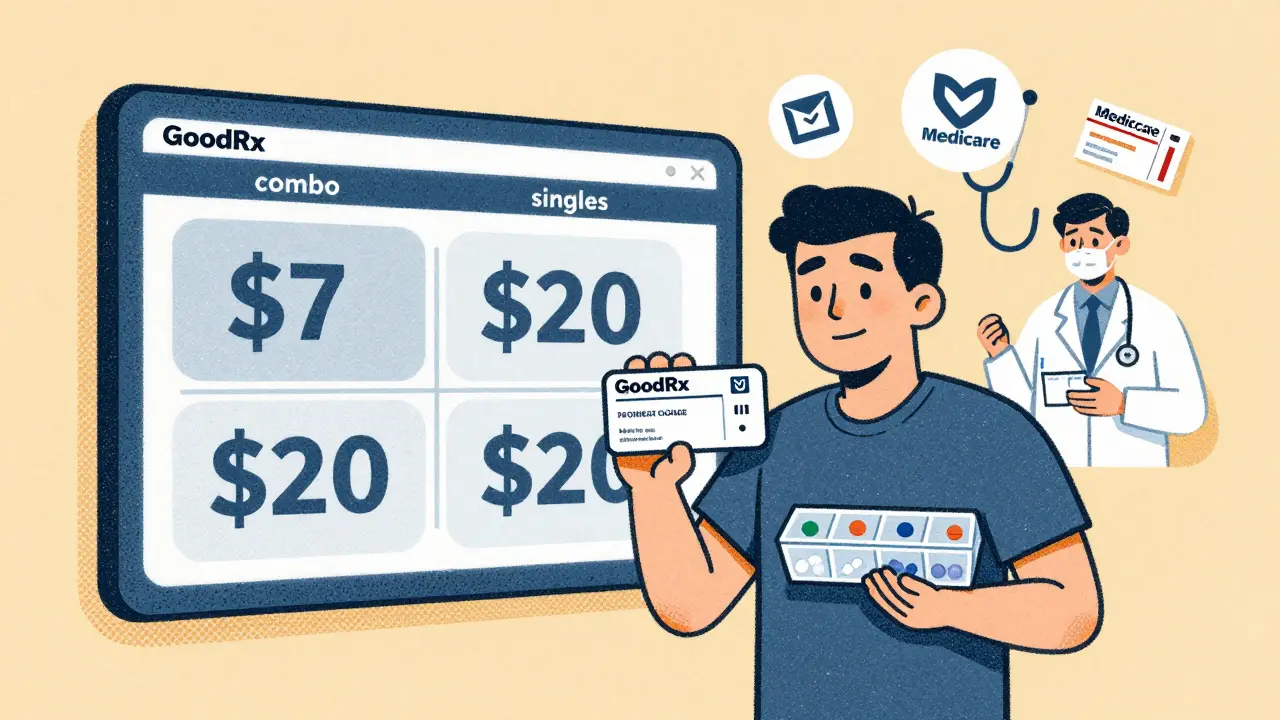

Another patient had the opposite luck: “My blood pressure combo went generic last year. My copay dropped from $45 to $7. No change in how I felt. Just cheaper.”

The difference? It comes down to how the plan’s pharmacy benefit manager (PBM) structured the formulary. The three biggest PBMs-CVS Caremark, Express Scripts, and OptumRx-control 80% of the market. Each has its own rules. One might favor combinations for adherence. Another might favor individual generics to maximize savings.

Why Some Plans Push Individual Generics

Insurers often prefer individual generics because they’re cheaper to buy in bulk. When you buy two separate generics, the pharmacy gets two separate wholesale prices, which are usually lower than the price of the combo. Also, if the combo drug is made by only one manufacturer (a “single-source generic”), the price doesn’t drop as much. There’s no competition.Plus, some plans use “step therapy.” That means you have to try the cheaper option first-two individual generics-before they’ll cover the combo. If you can’t tolerate one of the pills, you can appeal. But that takes time.

When the Combo Is Actually Cheaper

Don’t assume the combo is always more expensive. In many cases, especially for diabetes or heart failure meds, the combination drug is placed in Tier 1 because it improves adherence. Taking one pill instead of two means patients are more likely to stay on their treatment. And that saves insurers money in the long run by preventing hospital visits.For example, a common diabetes combo-metformin and sitagliptin-went generic in 2022. In many Medicare plans, it’s now a Tier 1 drug with a $5 copay. Buying the two separately would cost $8 and $12-$20 total. The combo wins.

It’s not about the ingredients. It’s about the plan’s design.

How to Find Out What Your Plan Covers

You can’t guess. You have to check. Here’s how:- Log into your insurer’s website or app and search for your exact drug names.

- Look for the “formulary” or “drug list.”

- Compare the copay for the combo pill vs. the two individual generics.

- Check if prior authorization or step therapy applies.

Medicare’s Plan Finder tool lets you compare plans by drug. In 2024, only 42% of plans made this info easy to find. If it’s buried, call customer service and ask: “Is the generic combination of [Drug A] and [Drug B] covered, and what’s the copay?”

What to Do If the Combo Is Priced Higher

If you’re paying more for the combo, you have options:- Ask your doctor to prescribe the two individual generics instead.

- Request a “coverage determination” appeal if you believe the combo is medically better for you.

- Use a mail-order pharmacy-sometimes they have better pricing on combos.

- Check GoodRx or SingleCare coupons. They often work even if your insurance doesn’t cover the combo.

There’s no rule that says you must take the combo. If the two separate pills work for you and cost less, your doctor can write two prescriptions. Just make sure your pharmacy can fill them together.

The Bigger Picture: Why This Matters

The U.S. generic drug market is worth over $135 billion and growing. By 2028, 93% of prescriptions will be for generics. Combination drugs make up about 15% of all prescriptions but 28% of top-selling drugs. As more combos go generic, insurers will have to make clearer choices.The Inflation Reduction Act, which took effect in 2024, capped out-of-pocket drug spending at $2,000 a year for Medicare Part D. That’s good news-but it doesn’t change how formularies are built. You still need to know which option is cheaper before you hit that cap.

And with the 2023 court ruling banning copay accumulator programs, patients can now use manufacturer discounts to count toward their out-of-pocket maximums. That helps people on brand-name drugs-but it doesn’t fix the confusion around generic combos.

What You Can Do Today

1. Review your current prescriptions. Are you taking any combo drugs? Check their copay vs. individual generics. 2. Ask your pharmacist. “Is there a cheaper way to get these meds?” They often know the best workaround. 3. Don’t assume the combo is better. Sometimes it is. Sometimes it’s not. Price matters. 4. Use free tools. GoodRx, SingleCare, and Medicare’s Plan Finder can show you real-time prices.You’re not supposed to be a drug pricing expert. But if you’re paying $300 extra a year because you didn’t ask, that’s money you can’t get back.

Are generic combination drugs as safe as individual generics?

Yes. The FDA requires generic combination drugs to be bioequivalent to their brand-name versions, meaning they deliver the same amount of active ingredients into your bloodstream at the same rate. They’re held to the same manufacturing standards. The only difference is that two ingredients are in one pill. For most people, they work just as well.

Why would my insurance cover two separate generics but not the combo?

It’s usually about cost structure. The two individual generics may be cheaper for the insurer to purchase in bulk, or the combo might be a single-source generic with no competition. Some plans also use step therapy, requiring you to try the separate pills first before approving the combo.

Can I ask my doctor to prescribe the two individual generics instead of the combo?

Absolutely. Your doctor can write separate prescriptions for each generic ingredient. Many patients do this to save money. Just make sure your pharmacy can fill both at the same time and that there are no interactions or dosing issues.

What if the combo drug is the only one that works for me?

If you’ve tried the individual generics and had side effects or poor results, your doctor can submit a “coverage determination” request to your insurer. This is a formal appeal. If approved, your plan must cover the combo. Expedited requests can be processed in 24 hours if your health is at risk.

Do Medicare Advantage plans handle this differently than Original Medicare?

Medicare Advantage plans (Part C) include Part D drug coverage, so they follow the same tiered formulary rules. But each plan sets its own list. Some Advantage plans have better combo coverage than others. Always compare plans during open enrollment using the Medicare Plan Finder tool.

Vicki Yuan

January 5, 2026 AT 08:33Just checked my Medicare Part D formulary last week-same story. Two generics at $8 each, combo at $42. I switched and saved $408 a year. No brain surgery needed: just log in, compare, and ask your pharmacist. They know the hacks.

Also, GoodRx had the combo at $17. Insurance didn’t even come close. Don’t trust the system-check it yourself.

Chris Cantey

January 6, 2026 AT 15:56The entire pharmaceutical-industrial complex is a Rube Goldberg machine designed to extract money from sick people under the guise of efficiency. This isn’t about cost-it’s about control. PBMs aren’t intermediaries; they’re rent-seekers with spreadsheets and zero moral compass.

Abhishek Mondal

January 8, 2026 AT 07:00Actually, you’re all missing the point-this isn’t about insurance, it’s about pharmacokinetic synergy! The FDA’s bioequivalence standard is a joke-it measures plasma concentration, not tissue penetration or receptor binding kinetics! The combination pill may have slower Cmax, higher AUC, and altered half-life due to excipient interactions! You’re assuming equivalence equals therapeutic equivalence-but that’s a fallacy rooted in reductionist pharmacology! Also, why are you all so obsessed with money? Health isn’t transactional!

Jennifer Glass

January 8, 2026 AT 13:24I love how this post breaks it down without jargon. I used to take the combo until I realized I was paying $30 more a month for convenience. Now I take two pills-yes, I forget sometimes-but I also have a pill organizer and a phone alarm. Worth the $360 a year I saved.

Also, my pharmacist told me the combo was priced high because it’s only made by one company. No competition = no price drop. Simple economics.

Joseph Snow

January 10, 2026 AT 12:30This is all a psyop. The government and Big Pharma conspire to make you take multiple pills so they can track your adherence via smart pill bottles. The combo pill? It’s a Trojan horse for surveillance. You think you’re saving money? You’re being monitored. Every time you take a pill, your data goes to OptumRx. They sell it to advertisers. Your hypertension is a commodity.

melissa cucic

January 11, 2026 AT 15:12It’s fascinating how the structure of formularies reflects deeper systemic inefficiencies-not just in healthcare, but in how we incentivize behavior. The fact that insurers reward non-adherence (by making the combo expensive) is a perverse outcome of cost-shifting models. The real tragedy is that patients are left to navigate this labyrinth without training or support.

And yet, the solution is so simple: transparency. If every plan published their pricing logic in plain language, this wouldn’t be an issue. But transparency is the enemy of profit.

Akshaya Gandra _ Student - EastCaryMS

January 13, 2026 AT 09:27en Max

January 13, 2026 AT 14:09It is imperative to underscore the critical importance of formulary tiering as a mechanism of pharmaceutical cost containment. The utilization of single-source generics, often devoid of competitive pricing pressure, results in suboptimal economic outcomes for the patient. Furthermore, the structural asymmetry between wholesale acquisition cost and retail copay creates a disincentive for adherence to combination regimens.

It is therefore recommended that patients engage in proactive formulary analysis, utilizing both digital tools and direct consultation with pharmacy benefit managers, to optimize therapeutic and fiscal outcomes.

Angie Rehe

January 14, 2026 AT 15:01Why are we still letting these PBMs get away with this? They’re not even trying to hide it. My plan literally lists the combo as ‘non-preferred’ even though it’s a generic. They don’t care if you miss doses or end up in the ER. They just want you to pay more for the same damn pills.

And don’t get me started on how they make you jump through hoops to get the combo approved. It’s cruel. It’s bureaucratic torture. And it’s all because they’re owned by the same companies that own the pharmacies. It’s a closed loop of greed.

Jacob Milano

January 15, 2026 AT 20:25Man, I used to think the system was broken. Then I realized it’s working exactly as designed-like a video game where the devs rigged the loot boxes. You think you’re getting a deal with two $10 generics? Nah. You’re just playing the long con. The combo? That’s the rare skin. The one that costs $50 because someone’s got a monopoly on it.

But here’s the twist: sometimes, the combo is the legendary drop. I got my metformin-sitagliptin combo for $5 last year. Felt like I won the lottery. It’s not about fairness. It’s about luck. And you? You’ve got to keep spinning the wheel.

Enrique González

January 16, 2026 AT 10:44Just switched to the combo after reading this. Copay dropped from $45 to $9. Didn’t even need to appeal. Sometimes it’s just luck. But now I always check before filling. One minute on the app, hundreds saved. Simple.

Aaron Mercado

January 16, 2026 AT 15:25This is why I don’t trust ANYTHING the government or insurance companies say! They lie to you about ‘affordability’ while charging you $50 for a pill that’s made for $0.50! I’ve seen the spreadsheets-they’re all rigged! And they want you to believe it’s your fault for not ‘doing your research’! No! It’s THEIR fault for making it impossible! I’m done playing their game. I’m going to the pharmacy and paying cash for the combo-then posting the receipt online to expose them!

Dee Humprey

January 17, 2026 AT 14:07Just wanted to say thank you for this post. I’ve been on blood pressure meds for 8 years and never knew this was happening. I switched to two generics and saved $312 a year. My pharmacist gave me a free pill organizer too 😊

And if you’re scared to ask your doctor-don’t be. They’ve seen this a million times. Just say: ‘Can we compare the copays?’ They’ll be happy to help. You’re not being difficult-you’re being smart.